Colliers Q2 2024 Retail Market Report

Colliers Q2 2024 Retail Market Report

To view in web browser to DOWNLOAD report,

visit: https://tinyurl.com/4kdft7w4

Consumer Spending Slowdown Anticipated

Consumer Spending Slowdown AnticipatedKey Takeaways

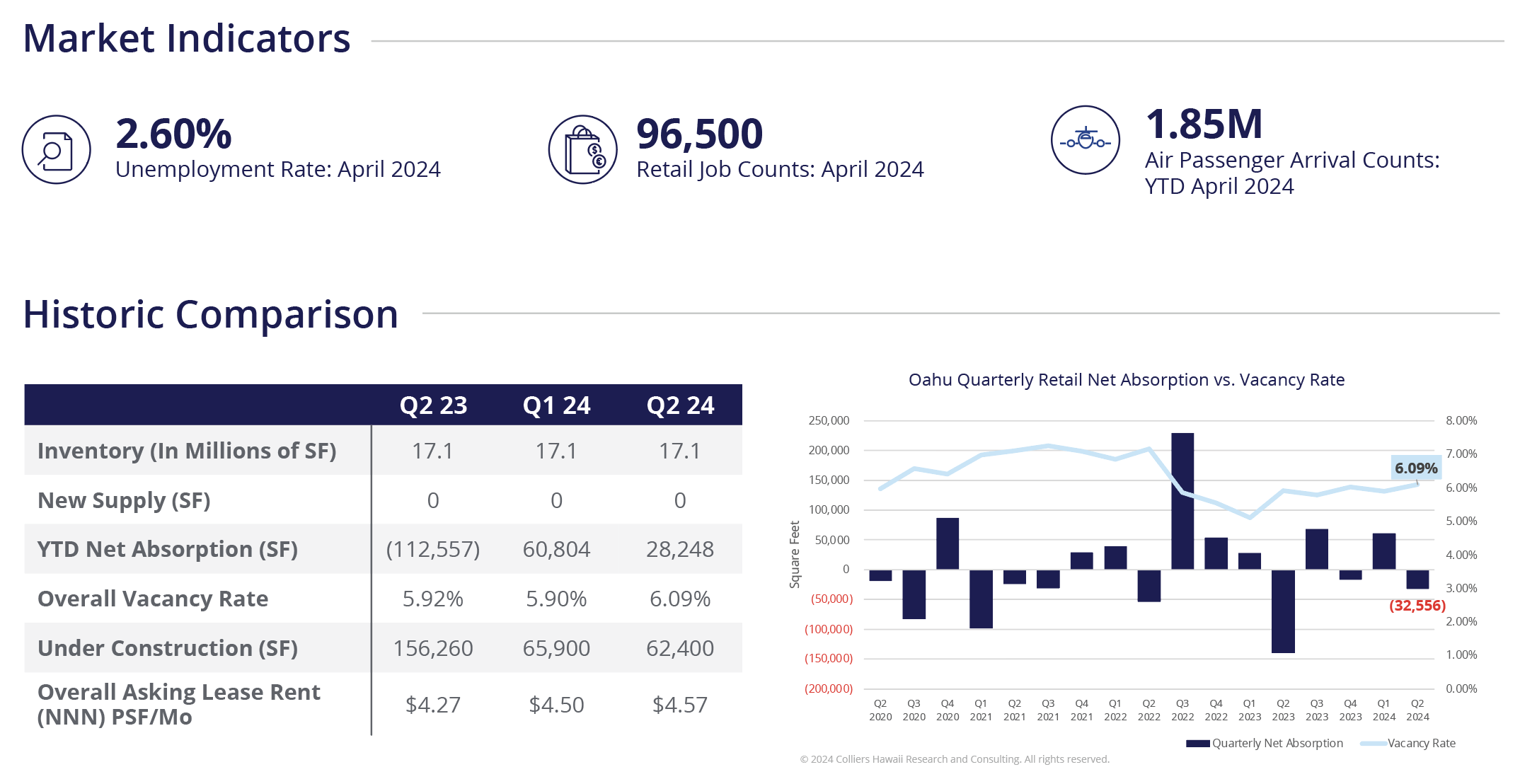

- Oahu posted a second quarter loss of 32,556 square feet of occupancy as vacancy rates rose above 6.0%

- Oahu’s economy is projected to avoid a recession, although GDP growth is slowing

- Urban Hawaii inflation re-emerges with rising prices for food, shelter and energy

- Waikiki’s retail market evolves with a surge in U.S. domestic arrivals

After starting the year with a robust gain of 60,804 square feet of occupancy during Q1 2024, the Oahu retail market reversed course, losing 32,556 square feet of those initial gains. Early optimism that retailers would stabilize was challenged by a saw-toothed pattern in vacancy rates, with alternating quarters of gains and losses in net absorption over the past six quarters. By the end of Q2 2024, Oahu’s retail vacancy rate escalated to 6.09%, marking its highest level in the past two years.

Despite the retail sector’s struggles in recent years, the market seems to be searching for a new equilibrium. While it is speculated that the retail market will eventually stabilize, post-pandemic volatility is expected to persist until inflationary concerns subside. Consumer confidence has hovered near a ten-year low, adversely affected by escalating food and grocery prices and as reflected in the May 2024 Consumer Confidence Survey where a growing number of respondents perceived an increased risk of recession.

Click below to view the summary version of the report and contact your favored agent for a copy of the full report.

Additional Info

Related Links : https://tinyurl.com/4kdft7w4

Source : Colliers